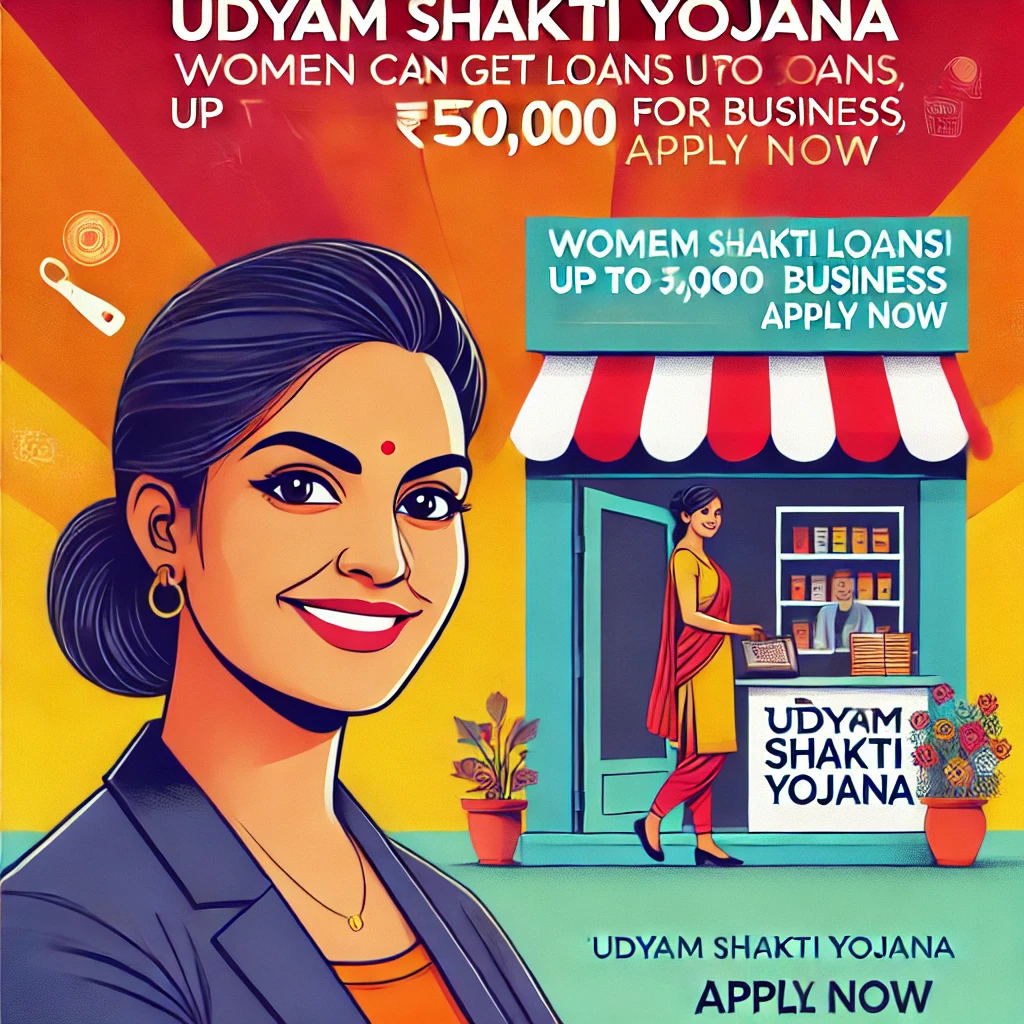

Udyam Shakti Yojana: In India, where women are often underrepresented in the business world, the government has been taking significant steps to empower them economically. One such initiative is the Udyam Shakti Yojana, a scheme designed to provide financial assistance to women entrepreneurs who aspire to start or expand their businesses. Through this program, women can avail of loans up to ₹50,000, giving them a crucial financial push to help transform their business ideas into reality.

What is Udyam Shakti Yojana?

The Udyam Shakti Yojana is an initiative launched by the Ministry of Micro, Small, and Medium Enterprises (MSME) to support women entrepreneurs in India. The scheme aims to encourage women to establish small businesses or scale up their existing businesses by providing them access to affordable financing.

This program is a part of the government’s broader effort to promote gender equality and empower women economically. By offering financial support, it helps to remove the common barriers women face in starting businesses, such as the lack of capital and access to formal credit.

Key Features of the Udyam Shakti Yojana

- Loan Amount: Under the Udyam Shakti Yojana, women can avail of loans ranging from ₹10,000 to ₹50,000. This amount is considered an ideal sum for small businesses in their early stages, as it helps to meet working capital needs, purchase equipment, and cover other operational costs.

- Eligibility: The scheme is open to women entrepreneurs across India. To be eligible, women must meet certain criteria such as:

- Must be a woman above the age of 18.

- Should have a valid Aadhaar card for identification.

- The business must be a micro or small enterprise (it could be in any sector such as retail, manufacturing, service, etc.).

- Preference is given to women who belong to Scheduled Castes (SC), Scheduled Tribes (ST), Other Backward Classes (OBC), and Minority communities.

- Simple Application Process: The application process for this loan is straightforward. Women can apply online through the official Udyam Shakti portal or approach local banks and financial institutions that are part of the scheme. They are required to submit documents like identity proof, business plan, and details of their enterprise.

- Low Interest Rates: The loans under the Udyam Shakti Yojana are provided at competitive and low interest rates, making it easier for women entrepreneurs to repay them over time.

- Flexible Repayment Options: The repayment schedule for the loans is flexible, which means women can repay the loan over an extended period, depending on their business’s cash flow and revenue generation.

- Capacity Building and Training: Besides financial support, the scheme also provides women entrepreneurs with training programs to help them manage their businesses more efficiently, improve their skills, and understand the financial aspects of running a business.

- No Collateral Requirement: One of the significant advantages of the Udyam Shakti Yojana is that women do not need to provide any collateral or security for the loan, making it accessible for those who may not have assets to pledge.

Benefits of the Udyam Shakti Yojana

- Financial Independence: The loan allows women to gain financial independence, reducing their dependency on others. It fosters a sense of confidence and security to pursue business ventures.

- Entrepreneurship Growth: Women with an entrepreneurial spirit can now transform their ideas into thriving businesses, contributing to economic growth and job creation.

- Gender Equality: The initiative helps to bridge the gender gap in the entrepreneurial ecosystem by providing women with the resources they need to succeed.

- Economic Empowerment: With the financial support provided, women can not only support themselves but also uplift their families and communities.

How to Apply for the Udyam Shakti Yojana Loan

Applying for the Udyam Shakti Yojana loan is a simple and accessible process. Women entrepreneurs can apply online through the official Udyam Shakti Portal. Alternatively, they can visit any of the partnered financial institutions or banks that offer this scheme. The basic steps include:

- Visit the portal or the partnering bank.

- Fill out the loan application form, providing details about your business.

- Submit relevant documents such as ID proof, business plan, and Aadhaar card.

- Wait for the approval process, which typically takes a few weeks.

Conclusion

The Udyam Shakti Yojana is a valuable initiative that empowers women to become self-reliant entrepreneurs. By offering financial support, training, and low-interest loans, the scheme plays a crucial role in boosting women’s participation in the business world. It is an excellent opportunity for women across India to turn their entrepreneurial dreams into a successful reality.

Women interested in the Udyam Shakti Yojana should act quickly and take advantage of this opportunity to start or expand their businesses. Whether you are just starting out or looking to grow your existing business, this scheme provides the financial backing needed to make your business thrive.

The Mukhyamantri Udyam Shakti Yojana is a state-level initiative aimed at empowering women entrepreneurs in India, especially those in smaller businesses, by providing financial assistance for starting or expanding their ventures. To avail of the benefits under this scheme, applicants must submit several important documents to ensure their eligibility. Below is a list of the required documents for applying to the Mukhyamantri Udyam Shakti Yojana:

Required Documents for Mukhyamantri Udyam Shakti Yojana

- Aadhaar Card:

- The applicant must provide a valid Aadhaar card as proof of identity. This is a mandatory requirement for verification purposes.

- Business Plan/Project Report:

- A detailed business plan or project report outlining the nature of the business, objectives, expected revenue, and how the loan will be utilized. This document is essential to show the viability and potential of the business.

- Bank Account Details:

- A bank statement or passbook showing the applicant’s business-related transactions or a proof of a business bank account. This helps in verifying that the applicant has an operational business.

- Income Proof:

- Income certificate or a proof of earnings to demonstrate the financial condition of the applicant. This may include income tax returns (if applicable) or salary slips for salaried applicants.

- Caste Certificate (If applicable):

- Women belonging to Scheduled Castes (SC), Scheduled Tribes (ST), or Other Backward Classes (OBC) must provide a caste certificate issued by a competent authority, as this may provide eligibility for additional benefits or preferences.

- Business Registration Certificate:

- If the business is already operational, a business registration certificate (such as GST registration, MSME registration, etc.) should be provided as proof of the legal status of the business.

- Residence Proof:

- A residence proof document, such as an electricity bill, water bill, or voter ID card, is required to confirm the applicant’s current address.

- Photographs:

- Recent passport-sized photographs of the applicant may be required for identification and record purposes.

- Educational Qualification Certificates (Optional):

- In some cases, educational certificates may be requested, especially if the scheme is aimed at promoting skill development or training for women entrepreneurs.

- Business Address Proof (If applicable):

- If the business operates from a separate location, a lease agreement or property tax receipt may be required to prove the business address.

- Social Category Certificate (If applicable):

- In cases where applicants belong to specific social categories like minorities, they should provide a minority certificate.

- Self-Declaration (if required):

- Some states may require applicants to submit a self-declaration stating that the information provided is true, and they have not availed of similar schemes in the past.

Additional Documents (if applicable)

- Financial Statements: If the business has been running for a while, providing balance sheets or profit and loss statements of the previous year can strengthen the application.

- Loan Repayment Records: If the applicant has availed of loans in the past, loan repayment records may be needed to demonstrate good financial standing.

Application Process

Once the documents are gathered, the applicant can submit them online through the official portal or directly at the concerned government office or bank. The processing time and documentation may vary slightly depending on the state, but having the above documents ready will ensure a smoother application process.

Conclusion

The Mukhyamantri Udyam Shakti Yojana provides a great opportunity for women entrepreneurs to get financial support for their businesses. To avail of this support, it is crucial to submit the correct and complete set of documents as listed above. Make sure that all documents are authentic and up-to-date to avoid any delays in processing the application.